Blog

Smart Beta Funds

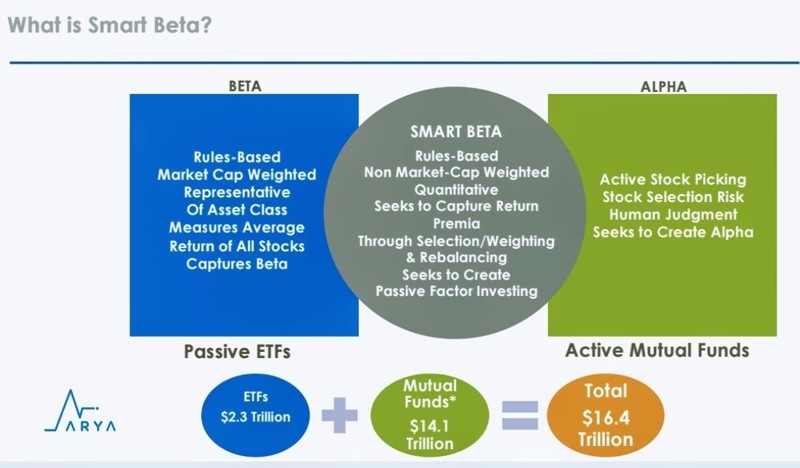

There are many definitions of smart beta, but ETFs classified as smart beta generally use a method that somehow tracks a market index, unlike traditional market capitalization, which is the weight of traditional index funds; The strategy added a handful of additional screens to the list of securities a particular fund can buy.

What is Smart Beta Fund?

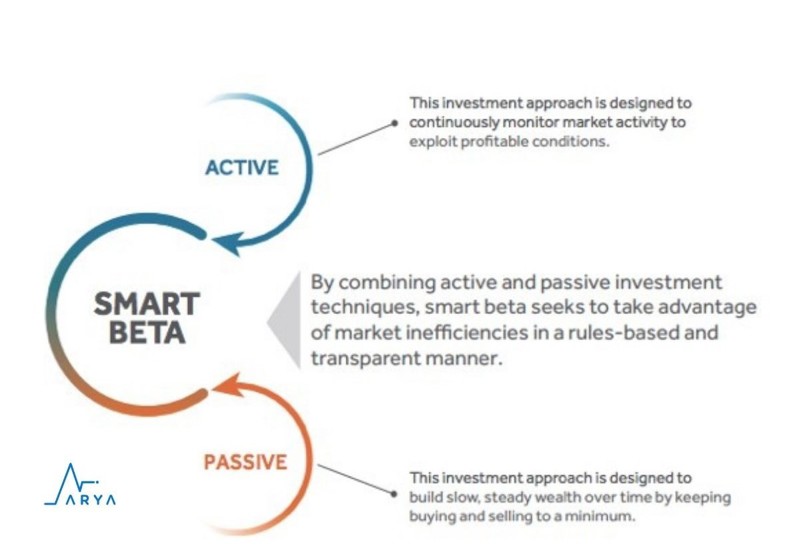

The advantages of passive and active investing strategies are combined in smart beta investing.

With smart beta, alpha can be obtained at a cost that is lower than traditional active management and slightly more than investing in flat indexes while also lowering risk or boosting diversification.

It looks for the ideal layout for a portfolio that is properly diversified. In actuality, the efficient market hypothesis and value investing are combined in smart beta. The smart beta investment strategy is applicable to well-known asset classes such stocks, bonds, commodities, and multi-asset classes. Through his research on current portfolio theory, economist Harry Markowitz developed the first hypothesis of the smart Beta.

Main Assumptions of Smart Beta Funds

● Smart beta aims to combine the benefits of passive investing and the advantages of active investment strategies.

● Smart beta uses alternative indexing rules to traditional market cap based indices.

● Smart beta emphasizes capturing investment factors or market inefficiencies in a rules-based and transparent way.

● Smart beta strategies may use alternative weighting schemes such as volatility, liquidity, quality, value, size and momentum.

How Smart Beta Works

To understand the term "smart beta" it is necessary to review the meaning of beta as it applies to investment. Beta is a way to measure the volatility of a stock relative to the overall market (i.e. the S&P 500). The beta of the S&P 500 is expressed as 1.0. If a stock has historically been more volatile than the S&P 500, its beta will be higher than 1.0.

For example, a stock that is 20% more volatile than the S&P 500 has a beta of 1.2. Any stock with a beta above 1 is considered riskier than the index, but when the market goes up, its value should increase more than the index. If the S&P goes up 10% in a timeframe, the stock with a beta of 1.2 should increase 12% over the same period. Conversely, stocks with a beta lower than 1 pose less risk than the index, but are also likely to have lower returns.

Beta only measures volatility relative to the market, not whether a stock is performing better or worse than the market. Thus, a stock that performs 50% better in the up market than the S&P 500 and a stock that performs 50% worse in the down market will both have a high beta.

Smart Beta Funds Example

Each of the following three ETFs uses a different smart beta strategy that seeks value, growth, and dividend appreciation, respectively:

Vanguard Value Index Fund ETF Shares ETF (determines value using various fundamental ratios, including forward price to earnings (forward P/E), past F/E, dividend price, and price-to-sale. Fund at AUM as of April 2019. 77.25 billion have dollars.

The iShares Russell 1000 Growth ETF (book pricing, mid-term growth projections and sales growth per share) with net assets of $42.73 billion as of April 2019.

The Vanguard Dividend Appreciation Index Fund ETF Shares (VIG) aims to bring investment results similar to the Nasdaq US Dividend Achievers Select Index. The fund selects firms that have increased their dividend payments over the past 10 years and weights their stocks by market value. As of April 2019, VIG's AUM is US$40.94 billion.

Advantages and Disadvantages of Smart Beta Funds

Pros:

- Multiple investment strategies: Smart beta ETFs offer investors an ostensible way to invest in simple capital-weighted index funds through a variety of strategies that can suit an investor's investing style.

- Lower expenses than actively managed funds: Smart beta ETFs generally have lower expenses than actively managed funds.

Cons:

- Lack of evidence for a reliable strategy: Research has shown that the performance of smart beta ETFs is evaluated relative to blended ETFs. By benchmarking, smart beta theme portfolios do not consistently offer significant benchmark-adjusted returns.

- can be complex: The rules for individual smart beta ETFs can be complex, leaving investors undecided about the strategies they are actually pursuing.

- Higher expenses than index funds: Smart beta ETFs tend to be more expensive than index funds.

What Does It Mean for Investors?

Investors often look for ways to outperform the market in good times and bad. Smart beta funds aim to outperform index funds in both upstream and downstream markets while providing lower volatility. However, investors should carefully research the smart beta investment vehicles they are considering purchasing. A source of funds to evaluate the fund's performance over various periods in accordance with its strategy's objectives and when compared to the index.

Important Implications

Smart beta funds are a hybrid between index funds and actively managed funds. They try to outperform index funds by taking advantage of one or more performance factors other than market value. These may include momentum, liquidity, earnings, volatility or dividend growth.

Smart beta investment strategies can be used for fixed income assets such as bonds and stocks. Smart beta funds generally have lower expenses than actively managed funds but higher than index funds.

asdasd

11/16/2022, 8:03:10 PM

sadasddasd

sadasd

11/16/2022, 8:03:03 PM

asdsad