Blog

Modern Portfolio Theory

The establishment of the relationship between risk and return, one of the most fundamental points in the history of modern finance, has been recognized with the advance of "Modern Portfolio Theory”.

After that, a new dimension was brought to the literature by changing the traditional meaning used to describe this relationship. The traditional portfolio theory's ignoring of mutual funds and quantitative data paved the way for the Modern Portfolio Theory, which shook the foundations of the traditional portfolio approach.

Who proposed Modern Portfolio Theory?

Modern Portfolio Theory (MPT) or mean-variance optimization was introduced by American economist Harry Markowitz in a 1952 essay, for which he was later awarded a 1990 Nobel Memorial Prize in Economic Sciences

What is Modern Portfolio Theory?

Modern Portfolio Theory is actually a solution to a mathematical optimization problem that maximizes expected return given the level of risk. The solution to this problem shows that a risk-averse investor can create a portfolio that maximizes the expected return for each risk level. The curve formed by these portfolios is called the Efficient Frontier.

Assumptions of Markowitz Portfolio Theory

The underlying environment is based on the economic environment in which investors seek to obtain maximum returns while taking a minimum market risk for their investment portfolio.

One of the assumptions of Modern Portfolio Theory argues that risk is inherent in higher returns and that a single stock will not be sufficient regardless of its expected risk and return.

What the investor needs to do at this point is to reduce high-risk stocks and parities by investing in more than one stock or parity. Thus, the risk is diffused and he can better exploit the possibilities of diversification.

In other words, this theory warns investors not to put all eggs in one basket. The same warning applies to robots that perform automated operations. The distribution of capital among robots reduces risk and increases diversification.

Modern Portfolio Theory Assumptions

According to the theory, risk and reward are inextricably linked. Accordingly, what needs to be done is to provide a combination of stocks with a higher rate of return due to higher risk and stocks with a higher rate of return due to less risk.

The inclusion of different investments from different risk and return groups in a portfolio is perceived as the most rational in terms of investors' interests. In a way, this theory, which supports the spread of risks, accepts this process called diversification as its basic principle.

Basic Assumptions of Modern Portfolio Theory

Markowitz’s essential claims about Modern Portfolio Theory includes:

- Investors aim for profit maximization.

- Investors are rational and avoid all unnecessary risks.

- All investors have access to the same information.

- Taxes and transaction costs are not taken into account when making the decision.

- Investors alone do not have the power to influence market prices.

- Investors can borrow as much as they want at a risk-free rate of return.

The theory, which assumes that investors are risk averse, assumes that investors prefer a less risky portfolio over a risky portfolio with a certain level of return. The investor takes more risk only if the expected return is higher.

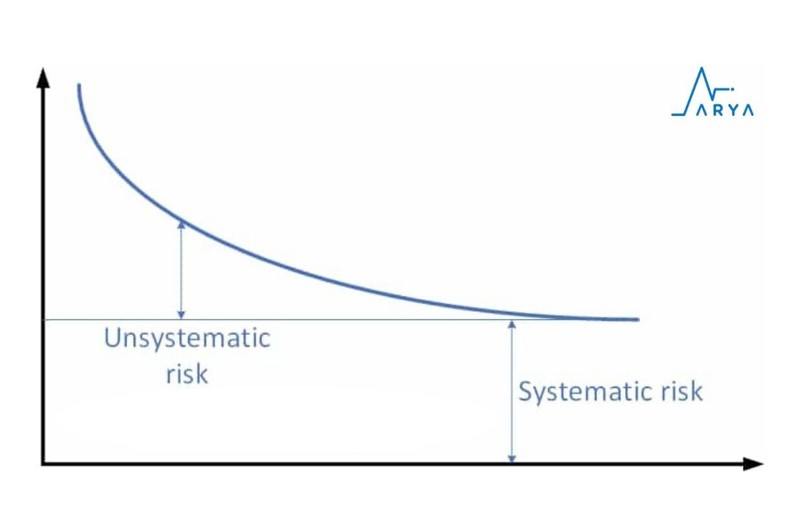

Within the scope of the theory, the risk is divided into two different categories.

- Systematic Risk

- Unsystematic Risk

Systematic risks are a type of risk that changes caused by economic, political, or sociological factors that affect financial markets. Systematic risk, also known as non-diversifiable risk, volatility, or market risk, affects the entire market and cannot be eliminated by creating a portfolio. Risks on factors such as interest, inflation, market, market, policy, and purchasing power are examples of this type of risk.

Unsystematic risks, on the other hand, show their effect in a specific sector or commercial institution. Contrary to systematic risks, the effect does not spread to the entire market and the market in general.

The diversity factor mentioned above is an effective prevention tool on unsystematic risks. Resources allocated to assets in different sectors play an important role in maintaining the existence of the portfolio with minimum damage in case of possible sector-based crises. Therefore, it can eliminate unsystematic risk by creating a diversified portfolio for a rational investor.

Modern Portfolio Theory Formula

MPT is based on two basic factors, return and risk. The following formula is used to find the expected return of portfolios. To calculate the amounts you choose, you can use a modern portfolio theory calculator.

The expected return of portfolio = (Weight of Asset A*Expected Return on Asset A) + (Weight of Asset B*Expected Return on Asset B)

Modern Portfolio Theory Example

Consider an investor holding a portfolio with $4,000 invested in Asset Z and $1,000 invested in Asset Y. The expected return on Z is 10% and the expected return on Y is 3%. The expected return of the portfolio is:

Expected Return = [($4,000/$5,000) * 10%] + [($1,000/$5,000) * 3%] = [0.8 * 10%] + [0.2 * 3%] = 8.6%

Modern Portfolio Theory Advantages Disadvantages

You can find some advantages and disadvantages of Modern Portfolio Theory as follows:

Advantages of Modern Portfolio Theory

Some of the opportunities and advantages that Modern Portfolio Theory offers to investors are as follows.

In addition to helping to evaluate and manage risks and returns, it can replace underperforming assets and assets with high return risk.

It is an important tool to avoid financial collapse. Investors, as they follow the theory, do not rely on a single investment and go for diversity. This opens up an important way for investors to achieve maximum returns with minimum risk.

Ultimately, the most efficient portfolio for investors is created through Modern Portfolio Theory.

Limitations of Modern Portfolio Theory

The point that the theory takes into account is the company's past performance. However, past performance cannot guarantee future results.

This theory assumes a normal distribution of returns on an asset within an asset class;, as asset class correlations can change has proven to be wrong for individual stocks.

Another potential problem is modeling expected returns based on mathematical calculations based on historical data. However, market fluctuations cannot be modeled. It also does not take into account any extra costs such as commissions or taxes.

Finally, modern portfolio theory assumes that most investors are risk-averse, fully rational, and have realistic investment returns. Anyone who has followed the stock market for any period of time understands that trades are not always made for rational reasons; Emotion can drive irrational activities. Also, some investors may really like to take the extra risk, assuming the rewards could be higher.

Post Modern Portfolio Theory

In today's world, investors have been trying to find alternative ways of modern portfolio theory and investment analysis to eliminate risks in those methods. Moving beyond modern portfolio theory caused alternative methods to appear for investors.

Behavioral portfolio management is among the modern portfolio theory alternatives which is aimed at building superior portfolios based on the pricing distortions created by investor’s emotional behavior. The core of behavioral portfolio management focuses on the specifics of how to build portfolios based on behavioral factors.

Modern Portfolio Theory An Overview

Modern Portfolio Theory, introduced by Harry Markowitz, focuses on the factors that are effective in creating accordingly, a combination of stocks with higher risk/return ratios and stocks with lower risk and return ratios is the most optimal option for investors.

The theory that risk and reward are inextricably linked also recommends including multiple investments in a given portfolio that vary in return and risk. This risk-spreading process is called diversification and is the basic principle behind Modern Portfolio Theory.

Also, the theory says that the overall risk of the portfolio's inclusion of securities can be reduced through diversification. If the investor is given two different portfolios with the same expected return, the rational decision would be to choose the portfolio with the lower total risk.

Although Modern Portfolio Theory is widely accepted all over the world and applied by different investment institutions, it has also been criticized by different people. However, regardless of the different criticisms, the Modern portfolio theory is a working strategy with a diversified investment, practiced by different risk managers, investment institutions and interested persons.

Frequently Asked Questions

What are the 2 key ideas of modern portfolio theory?

1. To maximize profit for whatever amount of risk is every investor's aim.

2. By diversifying a portfolio with distinct, unrelated securities, risk can be lessened.

What is the key assumption of modern portfolio theory?

A portfolio of assets can be put together by investors using Modern Portfolio Theory to maximize expected return for a particular degree of risk.

What is the importance of Modern Portfolio Theory?

A portfolio can be diversified using the contemporary portfolio theory to obtain a greater overall return with less risk. Reduced volatility is another advantage of diversity and contemporary portfolio theory.

Is Modern Portfolio Theory still useful?

Despite certain limitations, modern portfolio theory is nevertheless widely used today, especially by financial advisors who make stock and bond investments on their customers' behalf. Markowitz later received the Nobel Prize for his contributions.

What are the objectives of portfolio theory?

Modern portfolio theory is a method of investing. It aims to maximize returns while reducing market risk. MPT spreads assets among several asset classes via diversification. As a result, risk is reduced while yielding larger profits.

What are the limitations of modern portfolio theory?

The difficulty with MPT is that two different portfolios could exhibit the same amounts of variance but for various causes. One may exhibit variance as a result of frequent, small losses, whereas the other may do so as a result of two or three greater reductions.